Don’t Put Your Money Where Your Mouth Is

We’ve been told all our lives that paper money is gross. But in case you didn’t read the title of this article, guess what’s worse? Credit cards. And if you’re a bartender or server, you’re on the front lines touching god knows how many of them a day… so get prepared to be grossed out.

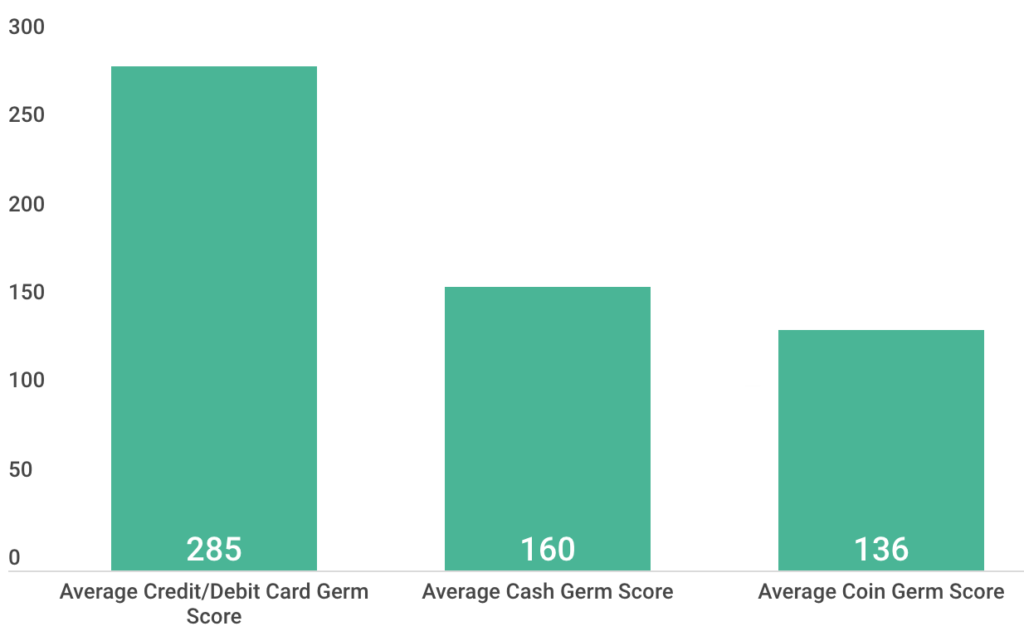

According to a study done by LendEDU the amount of bacteria found on the average credit card is usually about double the amount found on paper denominations.

The study used a numerical scale to compare how credit, cash, and coins stack up. For reference, a score of 10 or below is safe to eat off of.

Here’s what they found (on average):

- Credit/debit card: 285

- Card front/chip side: 252

- Card back/stripe side: 317

- Cash: 160 (the higher the denomination, the cleaner the cash)

- Coins: 136

The scariest part of all of this? They also tested a public restroom in Penn Station in NYC, and it got a germ score of 163. Long story short, you’re carrying around something nastier than a urinal in your pocket.

A World Without Credit Cards… Finally

Bart Wolbers, a researcher at Nature Builds Health, has a simple solution to dealing with dirty credit cards, coins, and cash. “Switch to digital payments as much as possible.”

It’s no secret that mobile payment has been slow to adopt in the United States–especially in bars and restaurants. Apple Pay launched six years ago, “…but it didn’t bring about the revolution it hoped it would where mobile payments lead the move toward a cashless society as it had in China,” says Tae Kim with Bloomberg. “Here in the U.S., there just wasn’t a compelling enough reason for many consumers to change their entrenched routines.” But as you’d expect, COVID-19 will change all of that.

A few reasons digital payments are about to explode:

- No touching = less germs

- A major increase in speed and security

- A “cool factor” associated with early tech adopters

- Vendors can offer purchasing incentives to customers through their apps and email

- Less things to carry into bars, outdoor events, etc.

Hospitality’s Reaction to a Pandemic

So what does this mean for hospitality? While most businesses that utilize digital payment have been retail, bars and restaurants have the most to gain because of the importance of operating in a sanitized space.

Eater recently reported on a few venues adopting new policies as of late:

- On Instagram, The Purple House in Maine wrote “we would ask as well that you consider paying with credit card or Mobilepay to avoid cash handling as a means of protection for our community.”

- Los Angeles pop-up Zoe Food Party said Venmo is “preferred until further notice.”

- Call Your Mother in D.C. noted it added “a new card reader so that guests can pay without handing over their credit cards.” Call Your Mother tells Eater it was already planning on installing its new card reader before any outbreaks, as it’s “it’s easier for both our team and guests and also allows for Apple/Google/Samsung Pay.”

- San Francisco’s Churn Ubran Creamery wrote it is “encouraging” contactless payment, as “receiving cash puts the staff and other customers at risk.”

- And notably, Dick’s Drive-In in Seattle, which was cash only for 62 years and only began taking cards four years ago, said that while it’s still taking cash, those interactions require “additional sanitation requirements,” so credit is now preferred.

Enter TabbedOut & Touchless Payment™

You may remember the mobile payment app, TabbedOut, from when it was a darling of the tech startup world a few years ago. Its core function was that it allowed the user to open and close their bar tab with their phone.

The customer could open a tab within the app and provide their bartender with a code that would connect the app to the venue’s point of sale system. But the best feature was that customers could pay and tip after leaving the venue, freeing up the bartender’s time. TabbedOut had tens of thousands of users and received numerous accolades, but was before its time, largely due to the lack of consumers willing to adopt digital payments in the early days of the smartphone.

Now TabbedOut is poised for a relaunch, better than ever, and ready to dominate the digital payment space for bars and restaurants. Touchless Payment™, is not only a no-brainer for an industry that requires regular health inspections, but also what many now view as a necessity in a post-Coronavirus world.

Customers can browse their local bars and restaurants using TabbedOut’s venue locator, then open a tab within the app from miles away before entering the building.

When a TabbedOut user walks into a venue that uses a UNION Point of Sale system, the POS will recognize the user via a virtual connection with their app and the bartender or server can select their name on the POS terminal.

Public safety and paperless checks are obviously the major selling points here, but TabbedOut’s secret weapon is the ability to push offers and incentives to customers directly through the app. Alcohol brands or the actual venues can provide customers with a redeemable discount through an in-app notification the moment they walk into an establishment or long before they get there.

For example, “Order a Canteen Vodka Soda and your first round is on us.” Or “Thanks for visiting Joe’s Restaurant for a 3rd time – Here’s a coupon for $5 off an appetizer.” These offers can then be auto-redeemed through the app at checkout.

Full disclosure, SIN is owned by TabbedOut’s parent company, UNION, but I’m not writing this article with a gun to my head. The truth is, this app is needed now more than ever and no one else is doing something this innovative in the digital space. If another company had beaten UNION to the punch with Touchless Payment™ for bars and restaurants, you’d better believe I’d be writing this piece about them.

So Now What?

The future is bright for digital payments and at the time of this article being written, there’s light at the end of the quarantine tunnel.

If you’re a bar or restaurant GM or owner, now is the time to prepare for the inevitable rise of digital payment.

And if you’re a bartender or server, you can sleep better knowing you’ll be touching a lot less disgusting credit cards when you finally get back to work.

In the meantime, wash your damn hands.